Annual open enrollment is always frustrating and discouraging for me. My options always seem to be to pay more, get less, or both. In the past, without any real health insurance alternative, I’ve grudgingly gone along with the program. I assumed it was all just part of the process—you get your renewal in the mail, you complain about it, then just pick the least painful option.

This year, I decided that I’d finally had enough.

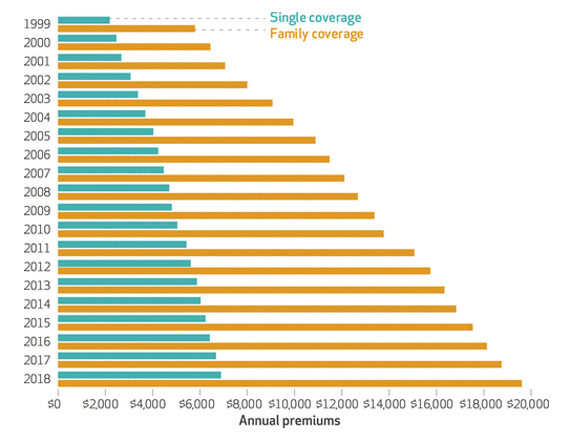

Constantly paying more and getting less is simply not a sustainable solution. It’s almost comical how we’ve become accustomed to the idea that annual rate increases are just the way it is. Having my rates steadily stair-step every year is just something I should expect and be ok with. Right?

I’m not. And you shouldn’t be either.

Sources: Henry J. Kaiser Family Foundation (KFF) and Health Research and Educational Trust Employer Health Benefits Survey, 1999-2017; and KFF Employer Health Benefits Survey, 2018.

How long can we expect to be able to absorb higher costs and lower benefits? Eventually (ie, now) we’ll be paying a ton of money every year in premiums, only to turn around and spend a ton of money out of pocket on our care.

That “system” just isn’t working for me anymore.

So this year, I chose to opt out altogether and give an innovative health insurance alternative a try.

Why it’s time for a health insurance alternative.

In the past, I’ve tried high-deductible health plans (HDHP) with a health savings account (HSA). I’ve been a fan of these types of plans since they were first introduced. I treat health insurance like any other insurance—for protection against the big, unexpected stuff that happens. I’m not a believer in “front-loading” paying for the care I may or may not need by paying for it in advance every month in the form of higher premiums. I want to pay for care when I need it, knowing I’m covered if something goes south while keeping my money in my own pocket.

HDHPs were perfect for someone like me. A tax-incentivized way to pay for unexpected care, and since the plan doesn’t actually pay for anything until you reach a certain deductible amount, there were some sweet savings with the premiums.

This used to work really well. The premiums for HDHP plans were about half of what you’d spend on a plan with a lower deductible, copays, etc. This allowed you to use that difference in premium costs to fund your HSA. For the same cost as one of those higher-priced plans, you had your premiums covered and your HSA funded should something come up. Done and done. Unfortunately, the premium gap has tightened considerably. There isn’t much wiggle room anymore.

As a matter of fact, when I looked recently at the monthly premium for an HDHP, it was now higher than some plans with a copay. Doesn’t exactly leave much to fund your HSA with…

Insurance used to be insurance.

Health insurance as we know it today is the result of a gradual, disjointed patchwork of efforts and regulations over the last 90 years. The original concept was a simple, straightforward system—a far cry from the complex, tedious, and convoluted supply chain we all hate navigating today.

Blue Cross was formed in 1929. Not really “insurance,” it allowed teachers to pay a hospital 50 cents per month as a way to prepay for if/when they ever had kids. That eventually grew and morphed to include care for illness and injuries. As the idea grew and spread, a group of doctors decided to adopt the concept, forming Blue Shield in 1939 to help cover the costs they were delivering to patients. The two groups finally joined forces in 1982.

Since then, what started out as a simple system has continually been adulterated by independent, incremental regulations at both the state and federal levels; the growing costs of care; the increasing availability of new technologies and services; and the consumer demand to have everything covered with a simple copay.

We’re now feeling the results of these disconnected, fragmented efforts.

There has to be a better way. (Spoiler: there is.)

Folks without insurance want the government to step in and provide coverage for them. Those with insurance want more choices and fewer restrictions from the states and the feds. Providers are continually coming up with new procedures. Innovative technologies continue to hit the market. All of these things fuel both rising costs, demand, and disjointed regulations. So what do we do when no one seems to be on the same page?

We pump the brakes, stop banging our heads against the same wall, and actually do something different.

For me, that meant opting out of traditional health insurance altogether and giving a medical cost-sharing membership a try.

What I like about medical cost-sharing.

I like the simplicity. Medical cost-sharing is a community where members contribute each month to help each other with large, unexpected medical expenses.

I like the fact that this health insurance alternative believes there is strength in the community and that members are connected through a shared commitment to living a healthy lifestyle. The program I’m enrolled in is also not faith-based like a lot of other medical cost-sharing programs.

I like the belief in personal accountability. Sadly, this is something that is becoming more and more absent from our current system.

I like the idea that we all have the ability, and should be empowered, to make our own health decisions.

I like the idea that I’m now a cash-pay patient and no longer have to think in terms of “in-network” or “out-of-network.” I can see any provider I want and shop based on price, provider ratings, reviews, and whatever other criteria I find important. And, with the assistance I get as a member, I often have more leverage and negotiating power with my bills.

I like the notion that by becoming educated, informed, and empowered consumers, we can all have a profoundly positive impact on the overall direction of our healthcare system.

I like the fact that my monthly costs dropped significantly while giving me arguably richer benefits (especially when coupled with a Health Access Solutions membership).

What makes my health insurance alternative different?

Because medical cost-sharing is not insurance, the terminology and how this health insurance alternative works are different. There are no deductibles, copays, or coinsurance. When I became a member, I had to select an Initial Unshareable Amount (IUA), which is the amount I need to pay for each Need before I can share my medical bills. Needs are the medical expenses caused by a single accident or illness. I chose an IUA of $1,500 (depending on the company you go with, you can choose an IUA between $1,000 and $5,000).

While there are some specific preventative care services that are eligible for sharing without having to meet my IUA, any other services are subject to meeting that initial amount before sharing. So, if I have an unexpected accident or illness, I pay my IUA, then submit the remaining medical bills to be shared with the community. Once processed, contributions are pulled from other members’ medical cost-sharing accounts and deposited directly into my own sharing account. I then use those funds to pay my provider directly.

In my case, let’s assume I go to the doctor for a sore throat, get checked out, have a strep test done, and get some antibiotics, and the total of all that is $250. Because that is less than my $1,500 IUA, it’s not shareable and I pay for it myself. If when I went in, however, they discovered that I needed to have a tonsillectomy and ended up with bills for $7,000, I would pay the IUA of $1,500, and the remaining $5,500 would be shareable.

I do have a couple of pre-existing conditions, so looking at how those are handled was important to me. With the company I signed up with, a pre-existing condition is a condition that has been active or needed treatment (even if not officially diagnosed) within 36 months prior to enrolling. Coverage for these conditions is stair-stepped, with no sharing eligibility for the first year, up to $15,000 shareable the second year, up to $30,000 shareable the third year, and fully shareable the fourth year.

To help support both my health and decision-making when it comes to my health care, my plan also includes access to Teladoc and Expert Second Opinion services. Teladoc gives me 24/7/365 access to board-certified physicians. 2nd.MD gives me access to medical specialists at no cost so I can consult with experts for a second opinion whenever I’m considering a non-emergency surgical procedure.

And while this health insurance alternative works well for me and my family, there were still a couple of holes I wanted to fill to give us a more complete solution. So I also enrolled with Health Access Solutions.

Health Access Solutions

The Health Access Solutions membership provides benefits that help plug any “holes” in the cost-sharing plan and makes this a much more comprehensive health insurance alternative. Some of these benefits include:

- Access to virtual direct primary care (VDPC). This lets me schedule video calls with the same doctor with no co-pays or hidden fees. By having a membership with a VDPC, I also get a discount on my monthly membership cost.

- Reimbursement for preventive services and screenings (up to a combined $4,500 per year). Services include annual physicals, lab tests, dental cleanings, and vision exams. There are no provider network restrictions. I simply submit for reimbursement and am reimbursed based on their schedules and maximums.

- Reimbursements for my gym membership (up to $250 per year) and mental health visits (up to $3,000 per year)

- Out-of-Pocket costs assistance. With my cost-sharing plan, I’m responsible for a max of 3 IUAs in a calendar year (it’s 5 for a family), after which all eligible needs are shareable without having to first meet my IUA. With this benefit from Health Access Solutions, I can submit my third IUA in a calendar year and get 100% of that IUA reimbursed.

This year, I bailed on the traditional health insurance model and decided to give medical cost-sharing, coupled with a Health Access Solutions membership a go instead. Through this health insurance alternative, I’m covering myself against large, unexpected medical issues, while taking a more active role in my own care, gaining more control over my health care costs, and saving a ton of money.

I’m also now in a much better position to be part of the solution.

WANT TO SEE IF THIS HEALTH INSURANCE ALTERNATIVE WILL WORK FOR YOU?